Caroline Ellison, whose testimony helped convict her former boss and ex-boyfriend, disgraced cryptocurrency mogul Sam Bankman-Fried, was sentenced Tuesday to two years in prison for fraud and conspiracy.

U.S. District Judge Lewis A. Kaplan sentenced Ellison in New York City to 24 months and ordered her to forfeit $11 billion for her involvement in the collapse of Bankman-Fried’s crypto exchange company, FTX. She had faced a maximum sentence of about 110 years.

Ellison, 29, accepted a plea deal on charges of conspiracy and financial fraud in December 2022, a month after FTX spiraled into bankruptcy. She testified against Bankman-Fried for nearly three days at his trial in November.

Bankman-Fried was convicted of all seven criminal fraud charges against him and sentenced to 25 years in prison. Prosecutors said in a court filing that Ellison’s testimony was the ‘cornerstone of the trial.’

Lawyers for Ellison had asked that she be sentenced to time served and supervised release, citing her cooperation. In a court document filed this month, her lawyers said she made a swift return to the U.S. in 2022 from FTX’s headquarters in the Bahamas and voluntarily cooperated with the U.S. attorney’s office.

Caroline Ellison leaves the courthouse in New York on Oct. 12. Stephanie Keith / Bloomberg via Getty Images file

She willingly worked with financial regulators in helping them understand what went wrong at FTX and at Alameda Research, FTX’s sister hedge fund, which she ran, the document said.With an unlimited credit line from FTX, Alameda Research received much of the $8 billion in FTX customer funds looted by Bankman-Fried, according to federal prosecutors. He used it for personal expenses, trading, Alameda debt payments and political contributions, Ellison and other witnesses alleged.

In seeking a sentence of time served, defense attorney Anjan Sahni said Ellison has “recovered her moral compass” and “profoundly regrets” not having left Bankman-Fried’s orbit.

Ellison addressed the court by reading from a statement in which she apologized to those she hurt and expressed shame for her part in the saga.

But Kaplan, describing FTX’s collapse as possibly the greatest financial fraud uncovered in U.S. history, said he could not agree to a “literal get-out-of-jail-free card’ for the defendant.

He ordered her to surrender to authorities on or after Nov. 7.

In the 67-page court document filed Sept. 10, FTX CEO John Ray, who has been guiding the crypto firm through bankruptcy proceedings, said Ellison’s cooperation with the government was ‘valuable’ in helping his team preserve and protect ‘hundreds of millions of dollars’ in assets.

Her lawyers wrote that Bankman-Fried forced her into a sort of isolation that ‘warped’ her moral compass. They said that at his direction, Ellison helped ‘steal billions’ while she lived ‘in dread, knowing that a disastrous collapse was likely, but fearing that disentangling herself would only hasten that collapse.’ Her work relationship with Bankman-Fried was further complicated by their on-and-off romantic relationship.

Ellison’s lawyers said Bankman-Fried had persuaded her to stay by telling her that he loved her and that she was essential to the business’ survival ‘while also perversely demonstrating that he considered her not good enough to be seen in public with him at high-profile events.’

Before it collapsed in 2022, FTX was one of the world’s most popular cryptocurrency exchanges, was known for its extensive lobbying campaign in Washington and its Super Bowl commercial.

Bankman-Fried and other top executives were accused of looting customer accounts on the exchange to make risky investments, buy luxury real estate in the Caribbean, make millions of dollars in illegal political donations and bribe Chinese officials.

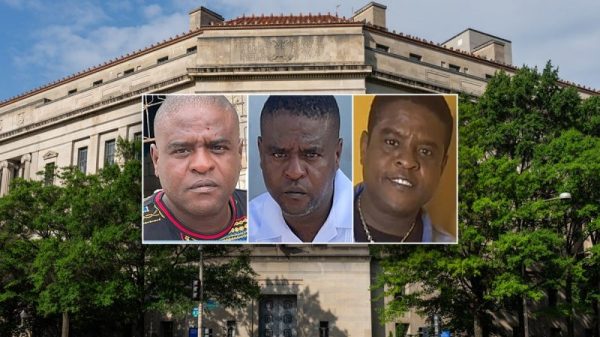

Ryan Salame, a former top lieutenant of Bankman-Fried, was the first of the FTX executive team to be sentenced. In May, a judge handed down a 7½-year prison sentence and ordered him to pay more than $6 million in forfeiture and more than $5 million in restitution.

Two other former executives, Nishad Singh and Gary Wang, will be sentenced in October and November, respectively.